MetLife Employee Benefit Trends

Financial Wellness Programs Foster a Thriving Workforce

Insights to help employees feel in control of their finances

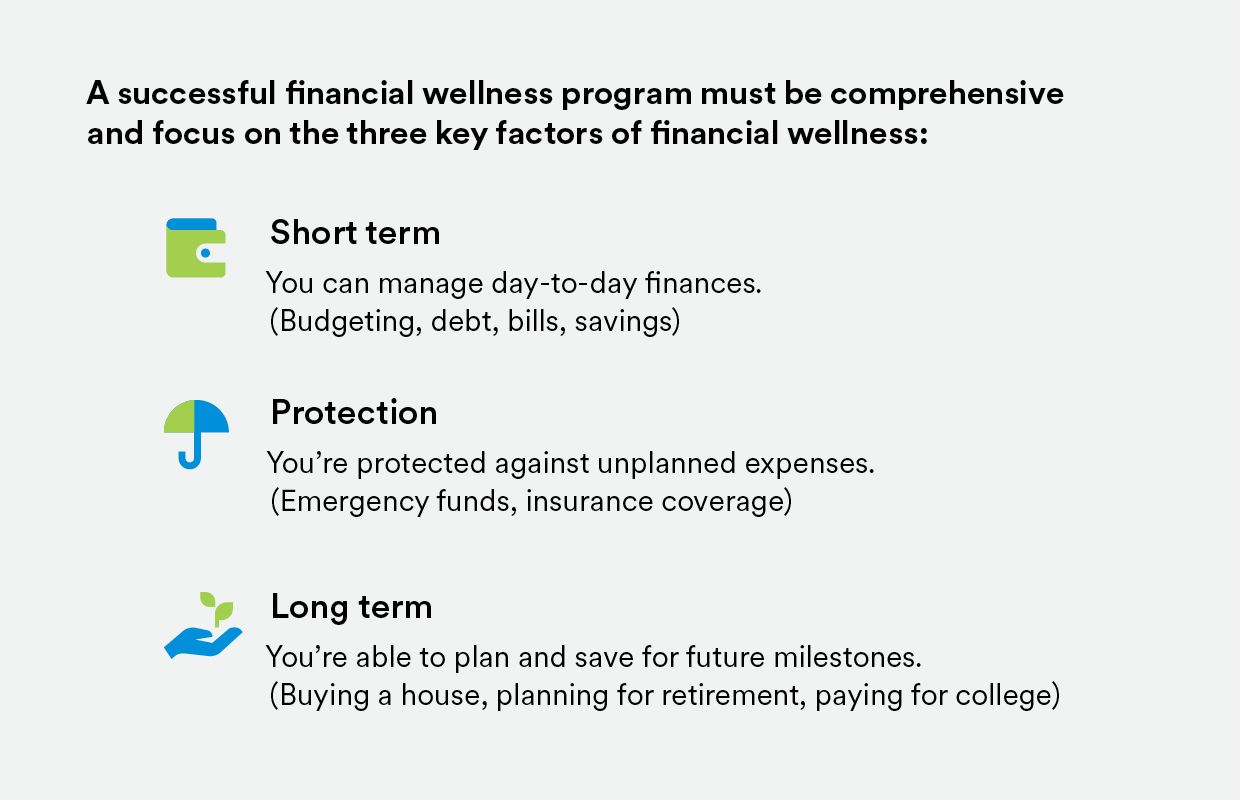

Financial wellness is the state of being in strong financial health

Individuals can successfully manage day-to-day finances, protect against unplanned expenses and financial shocks, and plan and save for future milestones.

DOWNLOAD STUDYFinancial Wellness Introduction

Across generations, life-stages, and socioeconomic statuses, all employees agree that personal finances is their number one source of stress.

Financial stress can lead to distraction at work, absenteeism, and high turnover. These challenges can have a significant financial impact on a business’ bottom line. For a company of 10,000, this can mean 1,922 hours and $28,830 in lost productivity every week. Overall, employers report $250 billion lost each year due to stressed employees at work.1

The stress that employees feel is significant — but so is the disconnect between their relatively strong perceptions of their finances and their actual financial wellness.

To help employees protect their families and plan for their short- and long-term goals, many employers offer a range of medical, voluntary, and retirement-related benefits. Yet, financial stress remains for employees. Employers are now recognizing they should help employees holistically connect the dots between these benefit offerings, so they understand how to use them to improve their financial wellness. Financial wellness programs are designed specifically to address this emerging need.

By taking a holistic approach, these programs can not only maximize the impact of employers’ investments in their benefits programs, but help employees meet their short- and long-term financial goals, too.

Financial wellness programs are not only in high demand, but, when delivered effectively, can serve as a differentiator in employee satisfaction, productivity, and loyalty.

Percentage of employees that want access to financial planning workshops or financial wellness tools

vs

Percentage of employers that offer these programs today

At MetLife, we are committed to supporting financial wellness in the workplace. In our 17th annual U.S. Employee Benefit Trend Study, we’ve uncovered insights that can help employers understand the positive impact financial wellness programs can have and how they can develop best-in-class programs to meet their employees’ needs.

Employees Financial Perceptions are Unrealistic

63% of employees feel financially confident

—but—

#1 source of employees’ stress: personal finances

What explains this paradox? While employees say they are confident, their actions and circumstances do not match their perceptions. Many are not successfully managing their short-term expenses, and therefore, are not on track to reach their long-term financial goals — causing a sense of financial insecurity that leads to stress.

This gap between what employees say and the reality of their day-to-day lives highlights the importance of educating employees and providing them with the right resources and tools to assess their true state of financial health.

This disconnect is particularly noticeable among younger employees, who relative to their older counterparts, have a higher rate of overlap in feeling both in control of their finances and living paycheck to paycheck.

This perception gap inhibits employees from truly understanding their financial situations and taking the appropriate action to plan and save.

Employees’ actions don’t match their desire to save for the future

Percentage of employees that say they are willing to make short-term financial sacrifices in order to have a secure retirement

vs

Percentage of employees that are directly allocating part of their paycheck to a savings account

Only 60% of employees have a budget or plan for how to spend their money on an ongoing basis — and actually stick to it. Older workers (Gen X and Boomers) and women in particular are less likely to have an ongoing budgeting plan in place.

Many employees may prioritize their short-term needs at the expense of their long-term goals

Employees are not only failing to save enough of each paycheck to meaningfully contribute to their retirement goals, but they are also often dipping into retirement plans to cover immediate financial needs.

Percentage of those with a defined contribution retirement plan and have dipped into it

Most employees who took a loan from their defined contribution plan say it was to pay off unplanned general expenses, suggesting that employees are not able to fully protect themselves against unexpected financial shock, whether it’s a flooded basement or a broken bone.

Medical bills are a significant burden, showing there is opportunity for employers to offer voluntary benefits—and educate employees on their value—to help ease out-of-pocket costs.

Immediate needs and future planning often compete for the same dollars, because of this, most employees — 63% — are behind on their retirement savings goals, even among those older employees nearing retirement. Many younger employees haven’t even begun to put money away for retirement. Surprisingly, among employees who are confident, only half are on track or have already reached their retirement saving goals. Due to their financial situation, employees are increasingly postponing retirement.

Gen Z and Millennials

Gen X and Boomers

Although employer-offered health and retirement benefits are an essential ingredient in solving for financial wellness, employees are not taking full advantage of these programs. Stress remains for employees, and they’re not making progress against their financial goals.

Financial wellness programs can do something salary and benefits alone can’t: help employees better understand their financial situations and leverage their benefits, so they can take action to set themselves up for success today and in the future.

To learn more about how employers can understand employees’ perspective on financial wellness, download the full study.

Financial Wellness Programs Benefit Everyone

Through financial wellness programs, employers can help employees get a better handle on their finances in order to mitigate their financial stressors. More broadly, employees who are on track in their finances tend to be more productive, engaged and loyal — reflecting top business objectives for employers today.

As work and life continue to blend, employers need to help alleviate the stress employees feel, so they can thrive in and out of the workplace. Financial wellness programs can significantly contribute to these objectives. It’s a win-win for both employees and employers.

Many employees expect their employers’ help with their financial wellness — particularly younger employers agree they have a role to play.

By creating holistic financial wellness programs that tie together benefits and guidance, employers can set their employees up for continued financial success, while at the same time, advancing their own organizational goals.

To learn more about how financial wellness programs are win-win for employees and employers, download the full study.

How to Build a Best-in-Class Financial Wellness

Employers have a wide range of options to consider when deciding what financial wellness programs are best suited for their diverse workforce. What may be right for one organization may not be right for another, so it’s important to take a holistic and employee-centric approach in evaluating potential solutions.

Employers can take action today to develop best-in-class, employee-centric programs, keeping four key principles in mind.

1. Start by gathering and assessing employee data

It’s necessary to uncover the magnitude to which employees experience financial anxiety and the extent to which those anxieties may be affecting the organization.

When conducting a financial-needs assessment, employers should gather demographic data — generation, life-stage, family structure, and financial circumstances — and analyze existing benefit plan data — such as retirement plan contributions and loans and disability claims — to assess the financial health and coverage of employees.

This quantifiable data can help employers define their financial wellness program objectives and tailor benefits accordingly to best help their employees.

2. Ensure a personalized approach

Because today’s workforce is diverse and multi-generational, often with unique career paths, employers need to offer and communicate solutions in a way that meet employees’ individual needs and support their whole selves.

Boomers who are behind in retirement may need personalized guidance to help them get on track to meet their goals. Gen X employees sandwiched between caring for children and aging loved ones may have a higher need for both child and elder-care. Millennials starting families and buying homes may need education on how life insurance can provide financial protection and how some legal solutions could assist with real estate matters and wills. Gen Z employees, more recently out of college, may value student-debt reduction programs.

3. Make it easy and enticing for employees to participate

Employers must consider a multi-channel approach, giving employees the flexibility to choose how and when they want to engage and take action — whether it’s online at their own pace, or in-person or on the phone with trained professionals. Ideally, solutions should integrate existing employee benefits to deliver cohesive education and coaching across multiple channels.

An effective program also breaks down suggested actions into attainable, goal-based steps. Communications should also be optimized with clearly defined action steps to support ongoing engagement.

4. Measure the impact and value of such programs

The most successful financial wellness programs allow employers to understand the impact they have on the workforce so they can gain insights into employees’ financial health and the return on their offerings. And because employees are constantly evolving, it’s a good idea for employers to continuously review and evaluate their workforce and its needs and desires — and simultaneously implement a measurement program that helps evaluate their programs’ effectiveness.

Increasingly, companies are using value-of-investment (VOI) to evaluate workplace financial wellness programs. VOI considers more than just hard-dollar savings — measuring elements such as employee productivity, engagement, overall job satisfaction, as well as costs associated with absenteeism, disability claims, and turnover. Key stakeholders across the company should work together to determine what metrics should be evaluated to assess program success.

Employers can take action today to help employees

There are tangible ways to offer a holistic financial wellness program that addresses the short-term, long-term, and unexpected needs of employees through the methods discussed. Keep in mind these benefits are tied together under a financial wellness program and should be evaluated using the best-in-class measures.

Financial Wellness Programs

Multi-channel access to help address the three key elements of financial wellness

Short-term expenses

- Make it easy for employees to allocate their paycheck to their savings

- Offer webinars and in-person sessions

- Offer programs to help employees manage and pay down their debt, including repayment

Unplanned expenses

- Connect voluntary benefits to financial protection (e.g., accident and disability insurance for unexpected injuries and income protection, home/auto insurance to protect your home and vehicle, etc.)

- Promote healthcare benefits that can help employees save (e.g., pre-tax accounts)

Long-term goals, including saving for big expenses and retirement

- Use auto-enrollment and auto-escalation in retirement plans

- Offer online tools that allow employees to view potential retirement outcomes

- Offer personalized financial planning services with one-on-one consultations

- Offer tools to help employees save for big expenses, such as purchasing a home and saving for college

It’s not only an opportunity, but a business imperative that employers take action to reduce employees’ financial stress. Employers can differentiate themselves through a financial wellness program that supports employees in their financial decisions to encourage a more engaged, satisfied, and loyal workforce — one that thrives in both work and life.

Ultimately, financial wellness programs help all employees — no matter their confidence level, pay grade, or title — understand their current benefits and individual circumstances to take action and improve their financial wellness, now and in the future.

L0319513030[exp0520][All States]