MetLife Legal Plans

With a group legal plan, you can have easy access to the expert legal help you need – from estate planning to real estate to traffic issues.

Legal Guidance for Life's Big Moments

Purchasing a new home? Starting a family? Dealing with an unexpected accident? Whether you are just starting out, married with kids or getting ready to retire, a legal plan can save you money on common legal issues.

MetLife Legal Plans gives you access to expert legal help so you can navigate life's big moments confidently. A legal plan can assist when you are:

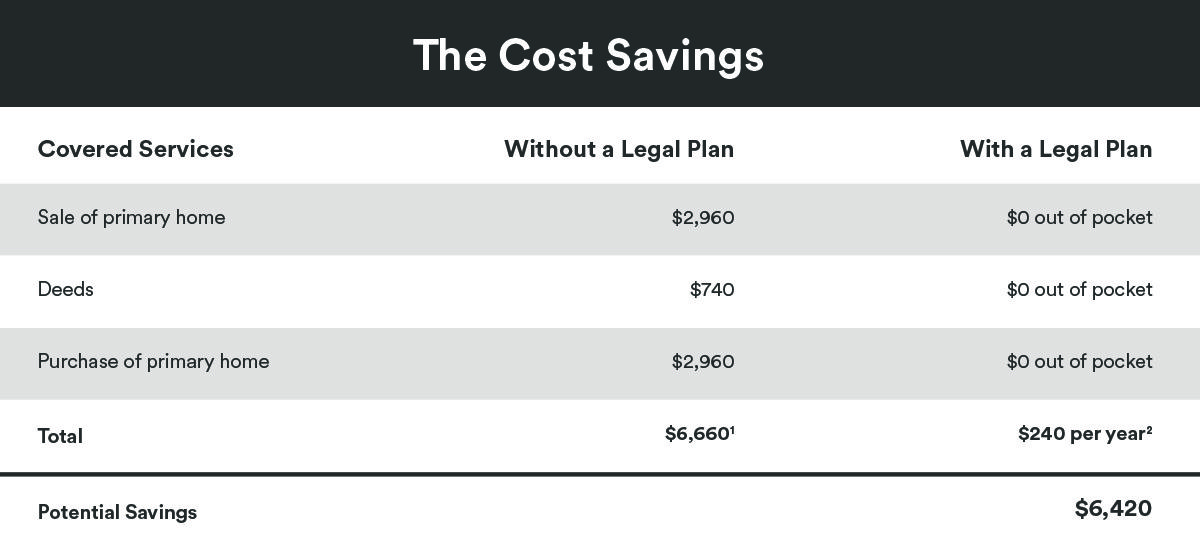

- Buying, renting, or selling a home and a need to have contracts, deeds, and purchase agreements reviewed or have an attorney attend a closing.

- Starting a family and need to create wills and estate planning documents, or handle school and administrative hearings, adoption, or reproductive assistance legal matters.

- Handling an unexpected issue like a traffic ticket, repossession, debt collection, or tax audit issues.

What Exactly Does MetLife's Legal Plans Offer?

MetLife Legal Plans offers easy access to the legal help you need for the common legal issues we all face. The legal plan is built around your needs and offers you:

- Experienced Attorney Network: You have access to the largest attorney network available, as well as the option to use an attorney outside of our network and be reimbursed for part of the costs.

- Access to Digital Tools: We provide a simple, guided process for employees to complete wills, living wills, durable power of attorney documents, and living trusts, all online in as a little as 15 minutes. This digital estate planning solution also provide real-time video guidance with both a notary and witnesses to finalize the documents.2

- Saves You Time: We can help you take the guesswork out of finding an attorney by providing easy access to the legal help you need.

- Comprehensive Coverage: With over 100 legal matters covered under our plan, you can see attorneys as many times as you need to throughout the year.

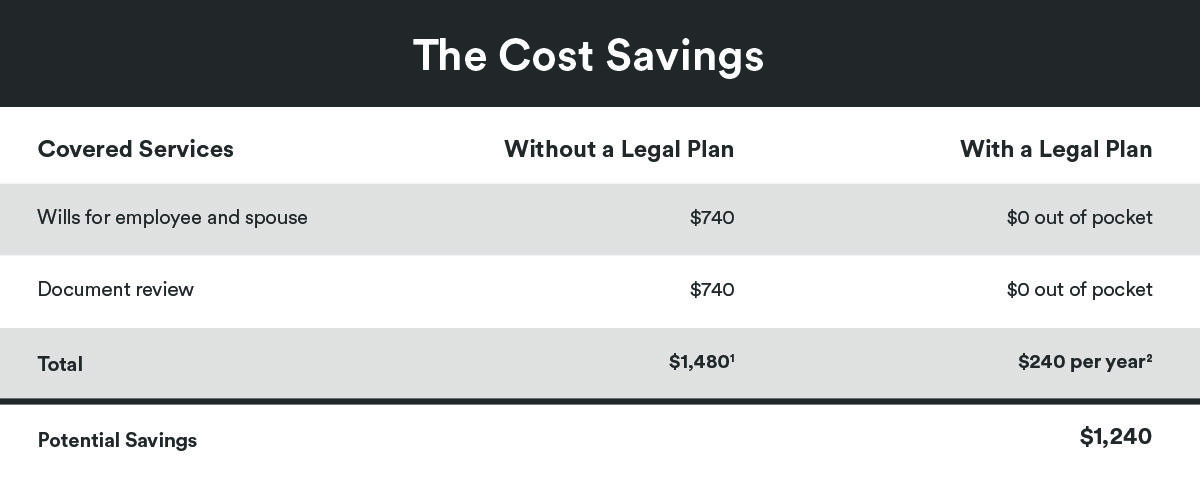

- Saves You Money: The average cost of MetLife Legal Plans coverage for the whole year is $20 - that's less than the average lawyer’s hourly fee of $370 an hour.3

See if You Qualify: Call 1-800-821-6400

How It Works

With a legal plan, there are no bills or claim forms to worry about when using a Network Attorney for a covered matter. For a low monthly rate, you simply find an attorney, make an appointment, and let MetLife Legal Plans handle the rest.

This service is tailored to your needs, so our network of attorneys is available in person, by phone, by email, and online so you can easily connect with an attorney or plan your next move. MetLife makes it easy to get the legal help you need by offering:

- Easy Connection to Attorneys: We can help you find an attorney near you or you can go online and find an attorney yourself. Once you've chosen an attorney, you will receive a case number so that you can contact the attorney to discuss your legal matter further.

- Unlimited Access: You will get full access to services without waiting periods, deductibles, copays, or claims forms.

- Flexible Service: Some legal matters can be handled online or through email, and in certain cases, the attorney may be able to represent you in court without requiring you to make an appearance.

Did You Know?

62% of working adults have been involved in a legal issue within the last three years.3

Legal Plans for the Unexpected

Tom and Linda hadn't thought much about the importance of legal coverage until one of their children was involved in an unexpected accident.

Legal Needs Calculator

This interactive tool shows you how much MetLife's legal plans can save you.

Always there when you need us

When Sarah and Matthew finally found their dream home, they were understandably devastated when the seller tried to back out shortly before their clos

Need Help?

If your employer offers this plan, enter your access code to learn more. If you're already enrolled, simply register or login.

Guiding You Through Life’s Big Moments

Legal FAQs

Enrolling in a legal plan is like having a lawyer on retainer on your side. When you use a Network Attorney for covered services, all attorney fees are covered by the legal plan. Payments for the plan are made through convenient payroll deductions.

For about $20 a month, our legal employee benefits program offers value, convenience and confidence by giving you easy and low-cost access to attorneys for a wide variety of personal legal services including advice and consultations on an unlimited number of personal legal matters.

Legal issues arise when you get married, have a baby, buy a home, lose a loved one, or need to have legal documents drafted. For example, with lawyers typically charging $370 an hour for services, the value of a prepaid legal plan is easy to see.*

A legal plan provides fully covered services for many of the most frequently needed personal legal matters, in addition to advice and consultations on an unlimited number of personal legal issues.

If you are a legal plan member, you can quickly access the member site to view coverage for the legal plan offered by your employer, or call our Client Service Center at 800-821-6400 (8 am - 8 pm EST, Mon - Fri).

If you are thinking about enrolling in the legal plan offered by your employer, visit our information center. Your HR or benefits department can provide you with an access code to log in.

You can also visit the Covered Services section to view examples of covered legal matters.

“Fully covered” means that all attorney services related to the covered matter are paid for by the legal plan when you use a Network Attorney. There are no co-pays, deductibles or claim forms when you use a Network Attorney. Also, you are entitled to advice and consultations for matters not fully covered by the plan, so long as they are not excluded. (See terms of service for a list of excluded matters.)

Yes, MetLife Legal Plans encourages members to use the plan to resolve as many legal issues as possible, even if they are pre-existing matters. The only pre-existing matters that are not covered are those for which you retained an attorney before becoming eligible for plan benefits.

MetLife Legal Plans is the only provider to cover office consultations and telephone advice for an unlimited number of covered and non-covered personal legal matters, so long as they are not excluded. These services are offered by local Network Attorneys.

MetLife Legal Plans offers a range of plan options, including customized legal plans for employers with more than 3,000 benefit-eligible employees. The legal plan provides a consultation benefit for most personal legal matters. What’s more, many personal legal matters are fully covered. For a list of fully covered services in your organization’s legal plan, please log in or call the Client Service Center at 800-821-6400. The following matters are excluded from all plans:

- Employment-related matters, including company or statutory benefits

- Matters involving the employer, Network Attorneys, MetLife and affiliates

- Matters in which there is a conflict of interest between the employee and spouse or dependents, in which case services are excluded for the spouse and dependents

- Appeals and class actions

- Farm and business matters, including rental issues when the plan member is the landlord

- Patent, trademark and copyright matters

- Costs and fines

- Frivolous or unethical matters

- Matters for which an attorney-client relationship exists prior to the participant becoming eligible for plan benefits