Pension Risk

Let us show you what steps your company can take to overcome the business challenges of mitigating your pension risk.

Celebrating a Century

Since 1921, MetLife has worked with companies on their de-risking journey while providing retirees financial security.

Current Pension Risk Landscape

We understand the risks associated with pension plan liabilities and how they can affect your organization’s balance sheet, cash flow, and income statement. And more and more, we’re noticing that these liabilities are becoming harder for companies to manage in today’s market and regulatory environment. That’s why organizations like yours are taking concrete steps to mitigate the risks associated with their pension liabilities.

De-Risking Strategies That are Available to you

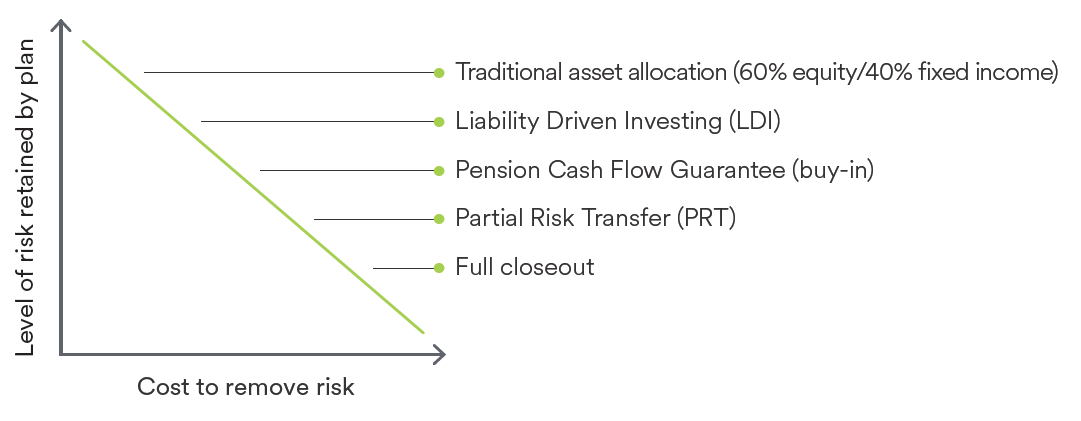

Your company can mitigate pension plan risk through a variety of strategies, including:

- Traditional asset allocation

- Partial risk transfers

- Full closeouts

Growing Interest in Annuity Buyouts

Because of their favorable low risk and costs, interest in annuity buyouts has increased. In an annuity buyout, your company would purchase a group annuity contract from us, transferring some or all of your company's defined benefit plan’s obligations and related risks to the issuing MetLife insurance company.1 You would retain the plan design features and benefits that your participants are vested in.

Preparing to De-Risk

Quantify & Evaluate

Examine all current plan costs and the financial impact that a risk reduction strategy may have on funded status, earnings volatility, and ongoing expenses.

Understand

Interpret the plan's economic liability — or the cost to settle the liability — and the accounting impacts of such a strategy.

Obtain

Secure the necessary internal approvals for action.

Monitor

Keep an eye on market returns and interest rates to identify the right time to implement your risk reduction strategy.

Quick Links

Roadmap to Transferring Pension Benefits

Pension Risk Solutions

Pension decisions today will impact many lives for years. See how we can help you decrease plan risk and protect retiree benefits.

Need More Help?

View our contacts